A property survey is one of those line items that often gets questioned late in the buying process. It is not flashy, it does not improve the house, and it is easy to see it as just another closing cost. Many buyers assume it is optional and wonder whether it is something they can safely skip.

The reality is that a survey is about the land the house sits on. Whether you need one is less about rules and more about understanding and managing risk.

What a Property Survey Actually Is

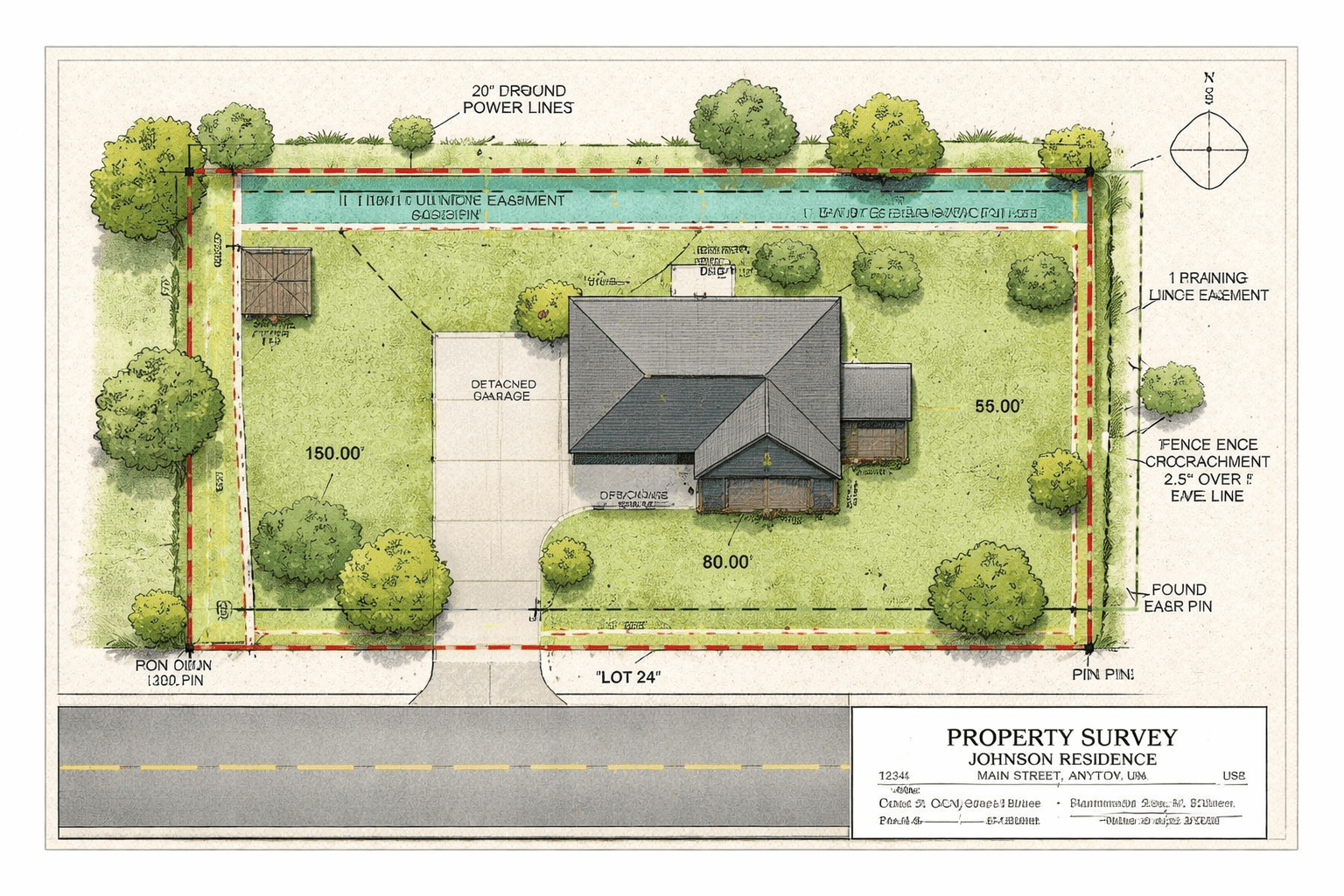

A property survey is a legal drawing that shows where a property’s boundaries are located and how the land is affected by recorded rights and visible use. It answers a simple but important question. What land are you legally buying?

Surveys often include terms buyers hear but rarely fully understand. Easements are recorded rights that allow others to use part of the property, such as utility access or shared driveways. Encroachments are physical improvements like fences, sheds, or driveways that cross property lines. In many subdivisions, a recorded plat survey shows standardized lot boundaries for the entire neighborhood.

What a survey typically shows is limited but critical:

- Property boundary lines

- Recorded easements and rights of way

- Visible encroachments affecting the lot

Just as important is what a survey does not do. It does not evaluate the condition of the home, confirm zoning compliance, or determine whether something is allowed under local ordinances or HOA rules. A survey documents boundaries, not permissions.

When a Survey Is Usually Required

Surveys are often optional until a lender or title company decides they are not. These decisions are based on insurable risk, not buyer preference.

A survey is more likely to be required when risk is higher. This commonly includes new construction, recently subdivided lots, large acreage or irregularly shaped properties, and situations where boundary lines are unclear or disputed. If there is no reliable and recent survey on record, the likelihood of a new one being required increases.

Requirements can vary by state, lender, and title company. Some lenders are comfortable relying on existing surveys, while others require new ones depending on the property and loan type.

The title company also plays a major role. Even if a lender is willing to proceed without a new survey, the title insurer may still require one to remove survey related exceptions from the title policy.

When You Might Be Able to Skip a Survey

There are situations where buyers reasonably choose not to get a survey. Condos and many townhomes rely on legal documents that define ownership boundaries internally, making traditional surveys less relevant. Recently surveyed subdivisions with recorded plats may also present lower risk when boundaries are clearly established.

Urban and suburban properties with small, standard lots and long-standing improvements often fall into this category as well. In these cases, buyers sometimes choose to proceed without a survey.

Skipping a survey does not eliminate risk. It means accepting it. Issues that surface later often involve unknown encroachments, access problems, or boundary disputes that complicate resale or refinancing. Once the transaction closes, options to address those problems are usually limited.

Cost vs Risk: Is a Survey Worth It?

There are situations where buyers reasonably choose not to get a survey. Condos and many townhomes rely on legal documents that define ownership boundaries internally, making traditional surveys less relevant. Recently surveyed subdivisions with recorded plats may also present lower risk when boundaries are clearly established.

Urban and suburban properties with small, standard lots and long standing improvements often fall into this category as well. In these cases, buyers sometimes choose to proceed without a survey.

Skipping a survey does not eliminate risk. It means accepting it. Issues that surface later often involve unknown encroachments, access problems, or boundary disputes that complicate resale or refinancing. Once the transaction closes, options to address those problems are usually limited.

How to Check If a Survey Already Exists

Buyers can sometimes find surveys or plats through public records, though finding one does not automatically mean it can be used. County land records offices often maintain recorded plats or surveys tied to a property. These can usually be searched online by address, owner name, or parcel number.

If you look on your own, focus on:

- Recorded subdivision plats or boundary surveys

- References in prior deeds to surveys or plats

- County ArcGIS maps for general orientation, not legal accuracy

Finding a survey answers whether one exists. It does not answer whether it is acceptable. The final determination is usually made by the title company, based on clarity, age, and insurability.

A Small Step That Can Prevent Big Problems

Surveys are not always required, and they are not always necessary. The mistake buyers make is treating them as a checkbox instead of a risk decision.

Sometimes skipping a survey is reasonable. Sometimes it is one of the cheapest forms of protection available in a real estate transaction. The right choice depends on the property, the timeline, and how much uncertainty you are willing to accept.