Should You Put Money Down on a VA Loan If You Have It?

When you hear “zero down,” it’s easy to think: why would I put money down? The VA loan program gives active-duty military families an amazing benefit—homeownership with no down payment required. But what if you have the cash saved? Should you use it, or hold onto it?

Let’s walk through the options with a bit of financial strategy in mind.

Why VA Loans Work Without a Down Payment

The VA guarantees 25% payment of your loan in the event of a default. That protects the lender and helps you skip the down payment and private mortgage insurance (PMI).

But just because you can skip the down payment doesn’t mean you always should.

The Benefits of Putting Money Down on a VA Loan

Putting even 5% down can lower your monthly payment in two ways:

- Smaller loan = smaller payment

- Lower VA funding fee

- Less Interest Paid

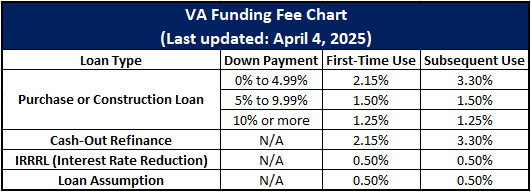

But before you decide how much to put down on your VA loan, it helps to understand how that choice affects your VA funding fee—one of the biggest upfront costs tied to your loan.

When Does It Make Sense to Use a Down Payment?

You might be wondering: “Wouldn’t I get a better return keeping that money in the stock market?”

Here’s a quick way to think about it.

Say you’re buying a $500,000 home with a VA loan and you’ve saved $25,000. You could either put it toward the house or keep it in a brokerage account.

Put it down, and your loan drops to $475,000. That trims your mortgage payment by about $157 a month, reduces your VA funding fee by over $3,625, and cuts your first-year interest by roughly $1,600. Altogether, you save close to $7,109 in year one. That’s a total return on investment of about 28.4% on your $25,000.

Keep it in the market, and you might earn 8–12%—around $2,000 to $3,000 if it’s a good year. But that return isn’t guaranteed, and meanwhile, you’re paying interest on the full $500K loan. You’ll spend more each month and more over time.

Lower Payments, More Exit Flexibility

Military families know that no duty station lasts forever. Even if you buy with plans to stay for two to three years, orders can change that timeline fast. That’s why lower monthly payments don’t just feel good now—they give you more options when it’s time to move.

Here’s how:

1. Easier to Cash Flow as a Rental

If you decide to keep the home and rent it out, a lower mortgage makes that math work more easily. Rent doesn’t have to cover a high monthly payment just to break even. That cushion makes it more likely your rental produces income—or at least doesn’t cost you money during vacancy or turnover.

2. More Pricing Power If You Need to Sell

In a softer market or a quick-turn PCS, having a smaller mortgage balance gives you wiggle room. You won’t feel locked into a certain price just to cover your loan. That flexibility can help you move faster and avoid paying out of pocket to cover any closing costs.

Final Thoughts: Use Your VA Loan Flexibility Wisely

Your VA loan benefit gives you options most buyers never get. No down payment. No private mortgage insurance. Competitive interest rates. But just because you can skip the down payment does not always mean that you should.

Using savings toward a down payment can create meaningful advantages. It reduces the size of the loan, lowers the monthly payment, decreases interest over time, and brings down the VA funding fee. This creates a smoother and more affordable path forward from the start.

A lower monthly payment can also support future plans. When it is time to move, the home may be easier to rent. Selling may feel more manageable. You may experience less financial strain during the transition. Flexibility becomes part of your overall plan.

Each household brings its own set of goals and preferences. Some buyers focus on stability. Others value the ability to plan ahead. All benefit from understanding how the VA loan works and how their decisions shape future options.

You’ve got options. Let’s use them well.