VA, Conventional, and FHA Explained

When it comes to buying a home, the loan you choose isn’t just about locking in the lowest interest rate or finding the easiest approval path. It’s about making a decision that aligns with your schedule, long-term wealth goals, and unique service eligibility. Many military families look at their home purchase as a stepping stone toward financial stability, and it can be. In our Guide to Buying Real Estate and Building Wealth, we break down how thoughtful decisions about financing and timing can compound over a career. True wealth is often created when you buy, not when you sell, which is why understanding your mortgage options from the start is so critical.

Choosing between VA, Conventional, and FHA loans is one of the earliest, and most important, steps in that process. This post walks through each of these loan types, explains funding fees, Private Mortgage Insurance (PMI), Mortgage Insurance Premium (MIP), and helps you weigh which option best supports your family’s financial and service-related goals.

VA Loans: A Military Benefit

For most service members and veterans, the VA loan is often the most advantageous mortgage option available. VA loans are backed by the Department of Veterans Affairs, which means that if a veteran or service member defaults on their mortgage payments, the VA compensates the lender for part of the loss, which reduces their risk profile on the loan. This protection gives lenders confidence to extend favorable terms such as, no down payment requirement, no private mortgage insurance (PMI), and competitive interest rates that are often better than what you’ll find with conventional financing.

One feature that makes VA loans unique is the funding fee. This one-time cost helps sustain the program so it remains available for future generations of service members. The fee is calculated as a percentage of the loan amount and varies depending on whether it’s your first or subsequent use, the size of your down payment, and your service category. For example, a first-time VA borrower who puts no money down typically pays 2.15% of the loan amount, while a borrower using the benefit again with no down payment could pay 3.3%. Making even a small down payment can reduce this cost significantly, with rates dropping to 1.5% or even 1.25%. Veterans with qualifying service-connected disabilities are exempt from the funding fee altogether.

Borrowers can choose to pay the funding fee upfront at closing or roll it into the loan. Rolling it in makes the process easier in the short term but does increase the loan balance, which means slightly higher monthly payments and more interest over time. This is why some active-duty service members choose to make a down payment even when it isn’t required, a strategy that can lower the funding fee and save thousands in the long run. Our guide on the VA Loan Down Payment Strategy breaks down how to weigh that decision.

VA loans can also be reused. Once you sell or pay off a VA-financed home, your entitlement is typically restored. In some cases, you can even hold more than one VA loan at a time, depending on eligibility. We cover this in more depth in Can You Reuse a VA Loan?. While subsequent uses may carry a higher funding fee, the VA loan remains an unmatched benefit for military buyers looking to build wealth with minimal upfront cost.

Conventional Loans: Flexible but Stricter

Conventional loans are mortgages offered by private lenders without any government backing. Because the lender assumes all the risk if a borrower defaults, these loans typically come with stricter credit and income requirements but in return, they offer more flexibility than VA or FHA loans. While down payments of 20% are often recommended, many lenders now allow conventional loans with as little as 3–5% down. This opens the door for borrowers who may not qualify for VA benefits but still want a low-down payment option. One of the biggest advantages is that conventional financing can be used not only for primary residences but also for second homes and even investment properties, making it an appealing choice for service members who plan to buy a retirement property or start building a rental portfolio during their career.

A key cost factor with conventional loans is private mortgage insurance (PMI). If your down payment is less than 20%, lenders require PMI as protection in case you default. This insurance doesn’t benefit you directly, but it allows you to buy sooner with less money down. The good news is that PMI can be canceled once you’ve built at least 20% equity, which often happens naturally over time as you make payments and home values rise. This makes conventional loans especially attractive for borrowers with strong credit who can take advantage of competitive rates and eventually shed the extra insurance cost. PMI costs vary depending on your credit score, down payment size, and loan-to-value ratio, but borrowers with excellent credit may find that the long-term savings outweigh the initial expense.

FHA Loans: A Bridge for First-Time or Lower-Credit Buyers

An FHA loan is insured by the Federal Housing Administration, which means lenders are protected against losses if a borrower defaults. That protection allows them to take on more risk, making FHA loans more accessible to buyers with limited savings or less-than-perfect credit. One of the biggest advantages is the low-down payment requirement — as little as 3.5% for many borrowers. FHA guidelines are also more forgiving when it comes to credit scores and debt-to-income ratios compared with conventional loans. This makes them a popular choice for first-time buyers and military families just starting to build their financial footing. Because of the government backing, interest rates can sometimes be competitive even for moderate-credit borrowers.

Where FHA loans differ most from VA and conventional options is in their mortgage insurance requirements. Borrowers must pay both an upfront mortgage insurance premium (MIP), typically 1.75% of the loan amount, and an annual premium that usually falls between 0.15% and 0.75% depending on loan size and term (HUD.gov). For example, on a $500,000 loan, the upfront MIP would be $8,750, while the annual premium could add $75 to $313 to the monthly payment depending on the borrower’s profile.

Unlike conventional PMI, which can be canceled once you build enough equity, FHA’s MIP often lasts for the life of the loan unless you make a down payment of at least 10% — in which case it may end after 11 years. While these insurance costs make FHA loans more expensive over time, they remain a valuable tool for buyers who need lower barriers to entry, especially those with limited cash up front or recovering credit.

Comparing the Loan Types in Practice

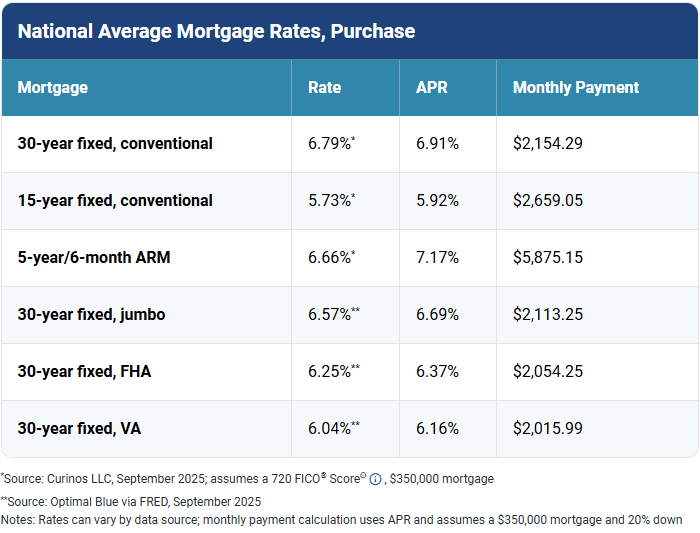

It’s common to come across charts on lender or credit websites that show VA, Conventional, and FHA loans side by side with their advertised interest rates and monthly payments. For convenience, we’ve included a similar comparison chart from Experian’s comparison of current mortgage rates, below to highlight how these loan types are often advertised.

While those snapshots can be useful, they can also be misleading if you only look at what’s on the surface. A mortgage isn’t just about the rate and the down payment requirement. What those graphics don’t show is the funding fee on VA loans, the private mortgage insurance (PMI) that conventional loans require when you put down less than 20%, or the mortgage insurance premiums (MIP) that FHA loans attach to most borrowers.

Over ten or twenty years, those costs can change the financial picture completely. A conventional loan that looks cheaper because of a slightly lower rate may actually cost more once PMI is factored in. An FHA loan with a low entry point can become expensive if MIP stays for the life of the loan. Even VA loans, while often the best fit for service members, include a funding fee unless you qualify for an exemption.

That’s why military families should be cautious about relying solely on rate comparisons. The best choice depends not just on rates, but also on how long you plan to stay in the home, your PCS timeline, and whether your strategy is to minimize upfront costs or maximize long-term equity and savings. Rate graphics give a snapshot, but the full decision requires looking at the whole picture and understanding the real variables at stake.

Final Thoughts

There is no “one size fits all” mortgage for military buyers. For most with strong eligibility, the VA loan is the go-to choice, but Conventional and FHA have roles in certain scenarios.

In your decision, weigh your PCS timeline, liquid finances, and how long you plan to stay in the home. If you expect to move in 3–5 years, minimizing upfront costs may trump long-term insurance savings. If you plan to stay 10–20 years, eliminating insurance costs (PMI or MIP) often saves money.

What makes the difference is looking beyond the surface numbers. Funding fees, PMI, and MIP can all reshape the true cost of a mortgage over time, and the “cheapest” option on paper today isn’t always the one that builds the most stability or equity. The families who get this right are the ones who approach each purchase not just as a short-term move, but as part of a larger wealth-building strategy.

At Combat Properties, we’re not lenders, but we specialize in helping service members and veterans understand their options and connect with trusted experts, like Nick Lewis with Atlantic Coast Mortgage. Whether you’re preparing for your first PCS purchase, reusing your VA loan, or considering a conventional or FHA path, the key is making an informed choice that supports both your family’s immediate needs and your long-term financial stability.